This is part of an ongoing phase-down to gradually reduce the top rate to 3.99 percent by 2027. Additionally, the 5.2 percent flat corporate income tax rate will also be reduced to 4.55 percent. Indiana’s flat-rate individual income tax will decrease from 3 percent to 2.95 percent as of January 1, 2026, because of legislation passed in 2023 (HB1001), with a further rate reduction to 2.9 percent on January 1, 2027.

Types of State Income Tax Rates

- This bill won’t solve the deficit, won’t make the tax code fairer, and won’t provide meaningful relief to working families.

- If you want to compare all of the state tax rates on one page, visit the list of state income taxes.

- The fee is imposed on consumers and collected by retailers at the time of the retail sale or lease of a CBE product and has been set at 1.5 percent of the retail sale price up to $15 per product.

- Corporate tax revenue supports various public services, including infrastructure, education and economic development.

- A CBE product is one that contains a battery that is not designed to be easily removed by the user with common household tools.

Illinois’s 1 percent statewide sales tax on groceries will be eliminated, effective January 1, 2026, as a result of H.B. However, many counties and municipalities have decided to replace the statewide sales tax on groceries with their own local levies, which is permitted by the law, with many of those taxes taking effect on the same date that the statewide tax will be eliminated. HB7031 also amended the definition of “corporation” so that charitable trusts are no longer treated as taxable corporations for Florida corporate income tax purposes. The District of Columbia is home to Congress and many federal agencies, so many public and private sector jobs are geographically tied to the District of Columbia.

What’s the Difference Between Federal and State Income Tax Rates?

Framed as a way to fund K-12 education, health care, higher education, human services, and the working families’ tax credit, while offsetting some sales/use and business & occupation (B&O) tax relief, the bill targets what proponents call the wealthiest 0.5% of state income tax by state households. It promises exemptions for family business sales and real property and includes credits for existing B&O, public utility taxes, capital gains taxes, and pass-through entity taxes. Louisiana has subjected S corporations to the corporate income tax but excluded income passed through to the shareholder, which then became taxable at the personal income tax rate of 3 percent.

State Income Tax Rate Changes in 2026

Every dollar over $1 million will get taxed at 9.9%, one way or another. You will be subject to the tax if you’re domiciled in Washington or if you maintain a home here and are present for more than 183 days. The duty day format uses the number of days an athlete spends „on duty“ playing in a game, practicing, participating in team meetings, travel days and – in the case of the Super Bowl – fulfilling team-related media obligations. HB3991 also makes significant changes to transportation funding in Oregon. Beginning January 1, 2026, the tax on fuels will increase from 40 cents to 46 cents, and diesel will be subject to the motor vehicle fuel tax.

- A duty day is a day in which the athlete performs work-related activities; for an NFL player, that includes not only the day of the game but also days traveling, practicing, attending meetings and otherwise preparing for the game.

- HB3940 levies a new tax on oral nicotine products beginning January 1, 2026, at 3.25 cents per unit with a 65 cents per package minimum.

- „The players have a really complex tax situation where they can have 10 or more different states that they’re having to file taxes for,“ he said.

- This tax will also begin to be automatically adjusted for consumer price inflation.

- For example, Virginia’s taxpayers reach the state’s fourth and highest bracket at $17,000 in taxable income.

- You will be subject to the tax if you’re domiciled in Washington or if you maintain a home here and are present for more than 183 days.

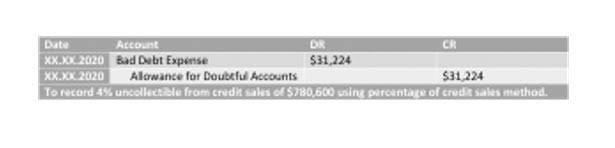

Mississippi is also Cash Flow Statement phasing out its economically harmful corporate franchise tax, a capital stock tax, which affects firms with significant property held within Mississippi. The 2025 corporate franchise tax rate of 75 cents per $1,000 in excess capital will decrease to 50 cents per $1,000 of capital in excess of $100,000 as of January 1, 2026. This reduction continues the gradual elimination of the tax, with full repeal scheduled for tax years beginning on or after January 1, 2028.

- Submitting multiple original returns will cause processing delays.

- Several states will see changes in their fuel taxes, including Michigan, Minnesota, Oregon, and Utah.

- Despite lawmakers’ professed goals of making the Commonwealth “more affordable,” HB 378 and HB 979 would actually make it less affordable, and Virginians have reason to be concerned.

- Like Virginia’s existing income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status.

- At the same time, the sales tax on cannabis will increase from 10 percent to 14 percent.

- Starting January 1, 2025, the lowest rate of 1.4 percent will apply to single-filer income below $9,600 (up from $2,400 in 2024), while the highest rate of 11 percent will apply to income exceeding $325,000 (up from $200,000).

- Smartphones are expected to represent over 65 percent of the new revenue.

- The tax base is your federal adjusted gross income, which can be found on line 11 on your 1040.

- The historic tables, however, have been updated to account for retroactive changes.

- Eight states, including New Hampshire, which repealed its interest and dividends tax in 2025, levy no individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns.

- SB1 phases down the current standard homestead deduction (currently $48,000 or 60 percent of assessed value, whichever is less) to $40,000 in 2026, with a phaseout in 2030.

HB4951 takes effect on January 1, 2026, and imposes a new 24 percent wholesale tax on cannabis. HB3 repeals Louisiana’s capital stock (franchise) tax effective January 1, 2026. SB1 also provides for https://www.3dconsultantsbd.com/bookkeeping-services-near-you-reliable-bookkeeping/ new stackable credits of $150 for qualifying fixed-income seniors, $125 for blind and disabled homeowners, and $250 for disabled veterans beginning with the 2026 tax year. Additionally, under HB7031, jet fuel, undyed kerosene, and aviation fuel will no longer be subject to the tax of 4.27 cents per gallon. SB1215 from 2022 imposes a new covered battery-embedded (CBE) waste recycling fee beginning January 1, 2026.